- #HOW TO ENTER EXPENSES IN QUICKBOOKS 2017 HOW TO#

- #HOW TO ENTER EXPENSES IN QUICKBOOKS 2017 DOWNLOAD#

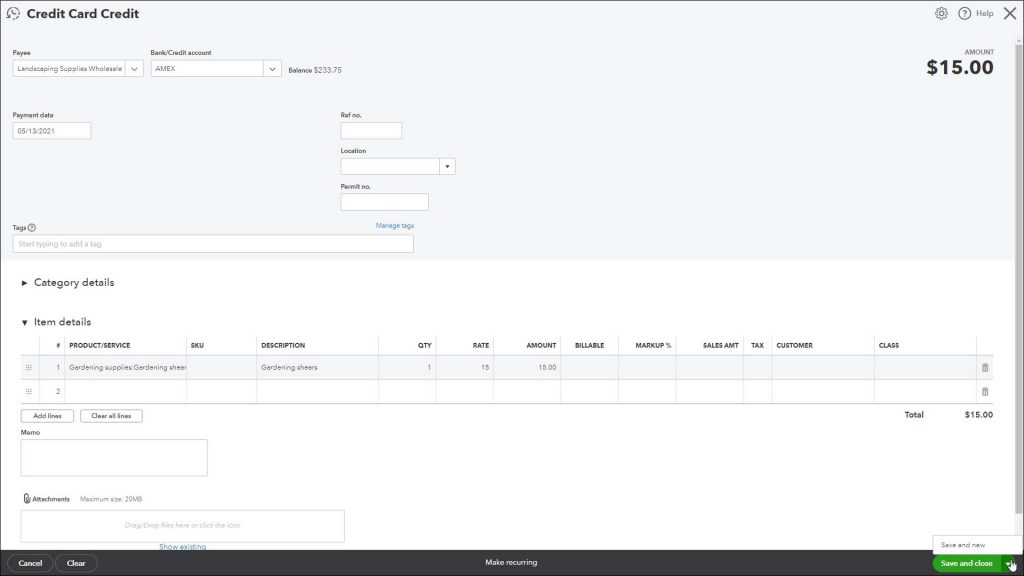

To enter expenses into QuickBooks, create the expense account in your chart of accounts and record the expense using the Enter Bills function.

#HOW TO ENTER EXPENSES IN QUICKBOOKS 2017 DOWNLOAD#

Download QuickBooks Accounting and manage your small business with this easy to use accounting app! You don’t need to be an accounting expert to keep your small business bookkeeping organized. But many successful contractors aren Construction Payroll. On the Invoice, you have no choice but to use an Item, but not on the bill (or check or credit card charge). QuickBooks, and general accounting conventions, provide two different approaches to measuring revenue. Whether you enter your expense into QuickBooks as a bill, check, or expense, you can mark it as billable.

EXPENSES = sandpaper, tooling, sharpening, glue, dowels, WD40, earplugs and stretch wrap.

There are six standard account categories used for tracking the financial activity of your business: assets, liabilities, equity, income, cost of goods sold, and expense.

#HOW TO ENTER EXPENSES IN QUICKBOOKS 2017 HOW TO#

How to Establish QuickBooks Items for Your Construction Business QuickBooks® definition of a contractor would be more specific if referred to as a sub-contractor. Categorize your overhead expenses by completing a few monthly expense reports before moving forward. Let’s use the example below of lighting fixtures. You can do this in QuickBooks by setting up a list of products or services in the application.In Quickbooks, I keep a separate expense account for “Materials On Hand” (nearly all materials I’m holding are expensed, as opposed to CapEx).” If this is a sub-account, place a check mark next to Is sub-account. Claiming actual costs requires solid recordkeeping and keeping receipts.Indirect costs need to be allocated against all contracts on a consistent and logical basis. Then have a second payroll cost in the general and administrative section of your chart of accounts.

0 kommentar(er)

0 kommentar(er)